Table of Contents

Are you an individual who enjoys spending time outdoors, tackling DIY projects at your home, or working on your farm or ranch? If so, you likely know Fleet Farm, your one-stop shop for everything outdoors, home improvement, and farm-related.

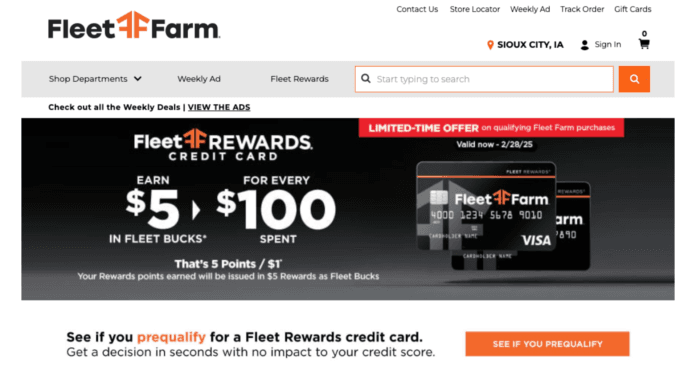

But did you know there is also a Fleet Farm credit card that can help you save money and earn more money on your purchases?

In this blog post, we will discuss the Fleet Farm credit card, its features, and many more such things to help you make the best experience out of your shopping at Fleet Farm. We’ll discuss the card’s rewards program, financing options, who should apply, and how to use the card responsibly.

Fleet Farm is a one-stop shop for outdoor enthusiasts, home improvement DIYers, farmers, and people living in rural areas. It’s well worth a browse at your closest Fleet Farm, whether that be camping gear, fishing tackle, tools and hardware, livestock feed, or workwear.

Now, you can get rewarded on top of that every time you shop at stores and support your favorite activities and projects with your credit card!

Important Features of Fleet Farm Credit Card

The Fleet Farm credit card has many useful features, making your shopping experience more rewarding. Here’s a closer look at what it provides:

1. Card Type

The Fleet Farm credit card is a store credit card that is co-branded with Visa. This means you can use it for purchases anywhere a Visa is accepted. That allows you to earn Tiered rewards and benefits at both Fleet Farm and beyond.

You can use it for everyday purchases like gas and groceries, or for those larger purchases like that new grill or camping gear.

2. Points Earned

You will earn 5 points for every $1 spent with Fleet Farm and 1 point for every $1 spent everywhere else Visa credit cards are accepted. Those points start to add up fast — particularly if you shop at Fleet Farm a lot.

3. Redemption Options

Points can be redeemed for discounts on future purchases, merchandise, and special events. They can either save their points for a bigger reward or redeem them for smaller discounts along the way.

4. Special Financing

With the Fleet Farm credit card, you can get special financing on qualifying purchases. This can make larger purchases more manageable as you spread out your payments over time.

5. Deferred Interest

You may qualify for deferred interest promotions, which means you can pay no interest for a set amount of time, as long as your balance is paid in full before the promotional period ends. That is a great way to pay less money on interest charges if you do a large purchase.

6. Promotional Periods

The card may also offer times with lower or 0% APR on certain purchases, making it manageable to finance bigger things. Make sure to read the fine print of these promotions so you know what you’re getting into.

7. Additional Benefits With The Fleet Farm Credit Card

The Fleet Farm credit card comes with additional benefits like:

- Access to exclusive discounts: As a cardholder, you may be able to access exclusive discounts on certain products or services. This is a good way to save some budget for your favorite items.

- Early access to sales: You might receive early access to sales and promotions before the general public, giving you the opportunity to grab the best deals.

- Birthday Bonus: Sometimes, you may receive a special birthday gift as a cardholder.

Who Is The Fleet Farm Credit Card For?

The Fleet Farm credit card offers an excellent option for all sorts of shoppers. It is beneficial for especially those who frequently shop at Fleet Farm or are interested in outdoor recreation-related items.

Here’s a closer look at who could get the most out of this card:

1. Regular Fleet Farm Customers

If you often make a stop at Fleet Farm to buy anything from fishing tackle and pet food to tools, this card is a good way to earn rewards with every swipe. Your points will add up the more you shop at Fleet Farm and you can use them to save on purchases in the future or obtain other rewards.

2. Outdoor Lovers

Are you an outdoor person who enjoys fishing, hunting, camping, or hiking? If so, the Fleet Farm credit card could complement your adventures nicely. Fleet Farm has a huge range of outdoor gear and apparel, and as with its credit card, you can earn rewards on those purchases.

Finally, you can also use the card to finance large purchases, such as a new tent or kayak. That makes it easier to get the gear you need to enjoy your favorite outdoor activities.

3. Home Improvement DIYers

If you are someone who is constantly taking on home improvement projects, no matter the size, the Fleet Farm credit card is a great option for you. Fleet Farm carries a variety of tools, hardware, building materials, and home improvement products.

As a bonus, you can earn rewards on those purchases by simply using your credit card for the payment, and you might even be able to save too with a special financing offer. This is especially useful on larger projects where a significant investment in tools and materials will be needed.

3. Farmers & Rural Residents

Fleet Farm is a favorite stop between working on the farm and living in rural America. They sell an extensive selection of agricultural supplies, equipment, livestock feed, and more. Whether your profession is working in agriculture or you just enjoy the rural lifestyle, the Fleet Farm credit card can help you manage what you’re spending and also earn rewards on your purchases.

It can be used to purchase a range of items from fencing and tools through to animal feed and workwear. That makes it an ideal option for all things farming and rural.

How to Apply for the Fleet Farm Credit Card

Do you want to start earning awesome rewards with the benefits of a Fleet Farm credit card? Here’s how you can apply:

1. In-Store and Online Applications

The Fleet Farm credit card can be applied for online and in-store, making it convenient. For that extra bit of comfort and to ask questions directly, visit your closest Fleet Farm store and speak with a customer service rep.

They can assist you with completing the application and answer your questions regarding the card’s features and benefits. If you’d rather apply where you are at home or on the go, you can apply online on the Fleet Farm website as well. To apply for the card, go to their credit card page and find the “Apply Now” button.

2. Fleet Farm Credit Card Eligibility Requirements

As is the case with most credit cards, there are some basic requirements you’re going to have to meet to be approved for the Fleet Farm credit card. Usually, they’ll review your credit history to evaluate your past credit management — such as your credit score, payment history, and any outstanding debt.

In general, you must have a solid credit profile to be approved. They may also factor in your income and employment history to ensure that you can meet your payments on time.

If you want to improve your credit score, refer to this article – 11 Best Tips to Improve Credit Score.

3. Application Process

The application process is typically quite simple no matter whether you apply in-store or online. Here’s a general outline of what you can expect:

- Have your info ready: Before you get started with the application, be sure to have all the information you need on hand. That includes your Social Security number, your driver’s license or other forms of identification, and information about your income and employment.

- Fill out the application: You will be required to enter some personal and financial information into the application. After providing all the required information, double-check everything, and submit! If applying in-store, a customer service rep will assist you in submitting it. You will submit it electronically through the website if you are applying online.

- Await a decision: You should get a decision on your application relatively soon after submitting it. If you’re approved, you’ll receive information about your credit limit and an estimated timeframe for receiving your card in the mail. If you apply in-store, you may even be able to get a temporary card that you can start using immediately.

3 Smart Ways to Use the Fleet Farm Credit Card

The Fleet Farm credit card is an excellent tool for saving money and earning rewards on your purchases. However, like any credit card, it should be used responsibly. Here are some tips to help you maximize your card while avoiding common missteps:

1. Effortless Rewards

When it comes to earning rewards with your Fleet Farm credit card, it’s as easy as 1-2-3. All you have to do is use your card for all of your eligible Fleet Farm purchases and at every place Visa is accepted.

Note that you earn more points on purchases made at Fleet Farm, so use your card there whenever you can. Fleet Farm also runs special promotions that earn you bonus points, so keep an eye out for those—when they are running, you can earn points super fast.

However, you can watch their website, or sign up for their email alerts, to be sure you hear about these opportunities. As far as redeeming, save up your points toward a bigger purchase or special outing, or redeem them for smaller discounts as you go. The choice is yours!

2. Control Expenditure

When you have a credit card, you can be tempted to spend on things you don’t need, but you need to exercise discipline and not overdo spending.

- Watch your spending: Before you buy anything ask yourself if it’s something you truly need or it is just a want.

- Set a budget: Stay within your budget, and be conscious of your credit limit so you don’t max out your card.

Keep in mind that to benefit the most from credit cards, you need to pay them off in full and on time each month to avoid interest and keep a healthy credit score.

3. Make the Most of Promotions

You can also enjoy special financing promotions, such as deferred interest or promotional periods with a reduced or 0% APR with the Fleet Farm credit card. These offers can be a great way to avoid interest charges on larger purchases.

If you’re considering a major purchase, whether it be a new grill or a new set of tires, take a moment to see if any promotions are currently in place that might get you the item for a better price.

All you need to do is read the fine print so you are aware of the details of the promotion and any interest the card can accrue if you fail to pay off your balance within the promotional period.

Wrapping Up

The Fleet Farm credit card is a good choice for anyone who shops at Fleet Farm frequently, especially if you like to spend time outdoors, on home improvement projects, or you’re a farmer.

With a rewards program offering generous perks, flexible financing options and all the other benefits it offers, it is a great way to help you save money and prepare for the purchases.

Who Is This Card Good For?

We recommend the Fleet Farm credit card for:

- Regular Fleet Farm shoppers: This card will allow you to earn rewards and save money on your purchase if you shop at Fleet Farm for your outdoor, home improvement, or farming needs.

- Outdoor enthusiasts: A hunting, fishing or camping buff who wants to get something back for spending money on their gear and equipment.

- No home is complete without a little DIY: If you’re constantly working on various projects around the house, this card can help you pay down purchases and earn rewards for the tools and materials you need.

- Farmers and residents of rural areas: This card can offer you some solid financing and rewards if you need supplies and equipment for your farm or ranch.

Next Steps

To learn more about the Fleet Farm credit card or to apply for it yourself, please visit the Fleet Farm website or one of their stores. It’s important to read the cardholder agreement which outlines all card features, benefits, and terms and conditions.

You can also talk to a customer service agent and ask any questions you may have or get assistance with the application process. FinBuzz is right here to help you with all your financial choices. If you liked this blog or want to suggest some improvements, don’t forget to comment below.