Table of Contents

Want a credit card that aligns with your conservative values? Coign might be the answer! However, getting approved can be a challenge if you don’t know their credit score requirements.

This blog post breaks down everything you need to know about Coign’s credit card, from credit score expectations to tips for improving your creditworthiness. We’ll guide you through the process, so you can confidently apply for a Coign credit card and get the financial tools you need while supporting causes you believe in.

First, let’s take a look at what a credit score is.

What is a Credit Score?

Your credit score is a three-digit number that summarizes how responsible you are with money. Your credit score helps guide lenders’ decisions about whether to lend you money and what interest rate to offer you.

A higher credit score means that you’re more likely to be approved for loans and credit cards, and you’ll typically get a lower interest rate. That means you’ll spend less over time.

Who Collects Information About Your Credit History

Credit bureaus are companies that gather information about your credit history. There are three primary credit bureaus: Equifax, Experian, and TransUnion. They collect data on your credit accounts, including credit cards and loans.

They consider how much money you owe, whether you pay your bills on time, and how long you’ve had credit. That information is used to generate your credit report.

Another company, called FICO, uses the information in your credit report to generate your credit score. The most widely used model is called FICO. The FICO score range is 300 to 850. The higher the score, the better.

What Different Credit Score Ranges Mean

- Excellent: 800 to 850 — You are a super-responsible borrower! Lenders see you as low-risk.

- Very Good: 740 to 799 — You have a good credit history. You stand a good chance of being approved for credit.

- Good: 670 to 739 — This shows you have a decent credit history. Most lenders will consider you a responsible borrower. You’ll qualify for most credit cards and loans, but you may not get the best interest rate.

- Fair: 580 to 669 — You have certain blemishes on your credit history that you could improve upon. You may remain approved for credit, but you may pay an elevated interest rate.

- Poor: 300 to 579 — You have an extensive negative credit history. It could be more difficult to qualify for credit.

It’s important to understand your credit score and how it’s affected. That can help you make good choices and get approved for credit when you truly need it!

Read More: Is 636 a good credit score?

Coign Credit Card Credit Score Requirements

Coign is a credit card company that aims to support conservative values. They provide a credit card with cashback rewards, and some of their merchant fees are allocated for far-right causes. However, what is the credit score you need to be approved for a Coign credit card?

Credit Score Requirements

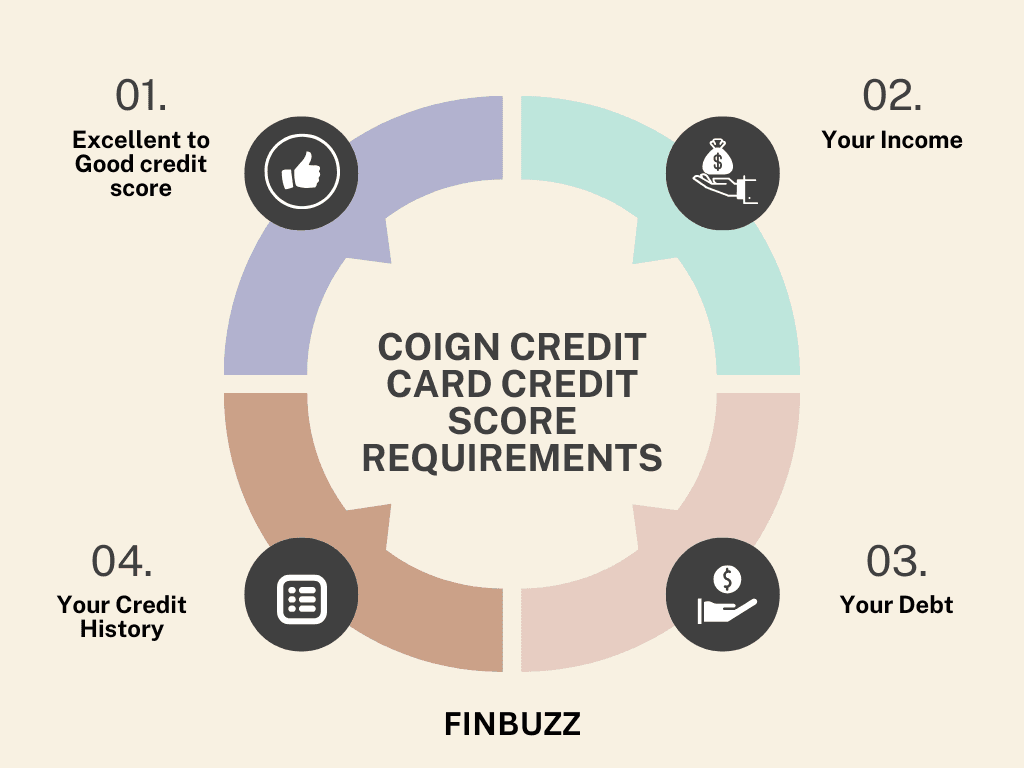

Although the company doesn’t disclose its exact score requirements, you’d need a credit score of good to excellent to qualify for this card. That usually means a credit score of at least 700. This is a rule of thumb. However, Coign might take other factors into consideration besides your credit score.

Other Factors Coign Considers

Whether you can responsibly manage your credit card or not, Coign wants to make sure you can. So, aside from your credit score, they might also consider:

- Your Income – Coign wants to ensure that you can consistently make your credit card payments, so it also checks that you have a steady paycheck. They may request proof of income, such as pay stubs or tax returns.

- Your Debt – Coign will evaluate how much debt you already owe — like other loans or credit card balances. They want to ensure you’re not overextending your debt.

- Your Credit History – Coign will take a look at your credit report to get a sense of how you’ve handled credit historically. They’ll check for things such as late payments, collections accounts, and bankruptcies. Having a long record of on-time payments will increase your chances of your application being approved.

Specific Coign Cards

Today, Coign only offers one credit card with 1% unlimited cashback rewards. They do not have different card tiers with varying credit score requirements. That said, they could always add more cards or tiers down the line.

5 Tips to Improve Your Credit Score

Want to boost your credit score and increase your chances of getting approved for a Coign credit card? Here’s how:

1. Pay Your Bills on Time

- Why it matters – Your credit score is a major factor that will be influenced by payment history. The timing of your late payments, and how many, can be extremely damaging to your score, especially if you’re 30 days late or more.

- How it helps with Coign – Coign is looking for you to have an income and to be responsible with that income. Paying your bills on time indicates to them that you’re trustworthy and able to handle a credit card.

- What to do – Set up automatic payments or reminders so you never miss a due date. If you’re struggling to keep these bills paid, you can reach out to your creditors before you miss a payment to see if you can set up a payment plan.

2. Keep Your Credit Utilization Low

- Why it matters – How much of your available credit you’re using is called credit utilization. Heavy use of your credit can decrease your score because it may suggest you’ve become too dependent on borrowing.

- How it helps you with Coign – A low credit utilization ratio suggests that you can manage your credit well and that you aren’t overextended.

- How to do it – Use no more than 30 percent of your available credit on each card. For example, if your card’s limit is $1,000, keep your balance under $300. Even better is paying your balance in full every month!

3. Check Your Credit Reports for Errors

- Why it matters – Errors on your credit report can damage your score. This can range from model errors, where you’ve entered incorrect account information, to account violations, where you aren’t the owner of the account.

- How it helps with Coign – Accurate credit reports help Coign get a true picture of your creditworthiness.

- What to do – You can receive a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once per year at AnnualCreditReport.com. Examine your reports closely and challenge any mistakes you notice with the credit bureau.

4. Don’t Apply for Too Much Credit at Once

- Why it matters – When you apply for credit, a hard inquiry appears on your report, resulting in a small dip in your score. Too many inquiries can make it seem as if you’re desperate for credit.

- How it helps with Coign – If you apply for a lot of credit cards in a short time period, you can appear risky to Coign. They might assume you’re going to take on too much debt.

- What to do – Apply for credit only when you need it. Don’t apply for multiple credit lines around the same time, particularly for high-dollar items such as loans or credit cards.

5. Build a Long Credit History

- Why it matters – The longer you have credit accounts in good standing, the better your score. This proves to lenders that you have a history of managing your credit responsibly.

- How it helps with Coign – A long credit history demonstrates to Coign that you have a solid track record of managing credit responsibly over time.

- What to do – Don’t close your oldest credit accounts, even if you rarely use them. This helps to demonstrate a consistent history of responsible credit use. If you’re starting from scratch, consider getting added as an authorized user on a responsible family member’s account in order to build your history.

By following these tips, you can improve your credit score and increase your chances of getting approved for a Coign credit card!

Wrapping Up

Getting a Coign credit card can be a great way to manage your finances while supporting conservative causes. Remember that a good credit score is key to getting approved. By understanding Coign’s credit score requirements and following the tips we’ve shared, you can increase your chances of approval.

Even if you don’t qualify right away, there are alternative options to help you build your credit. So, take charge of your credit health, apply with confidence, and enjoy the benefits of a Coign credit card!