Table of Contents

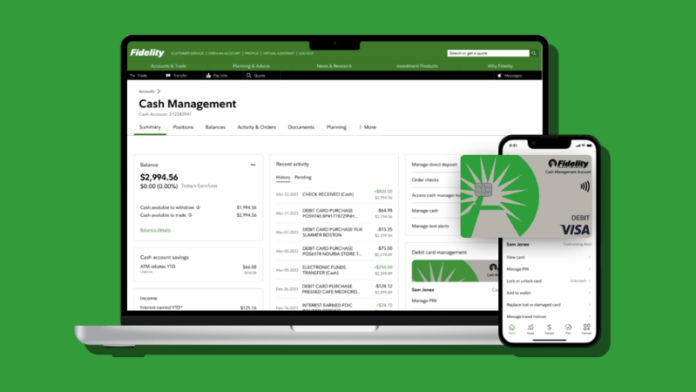

What is a Fidelity Cash Management Account?

The Fidelity account is amongst the world’s largest mutual funds firms, with over $2 trillion under its management. Fidelity cash management account customers can open brokerage accounts if they want to invest in bonds, stocks, mutual funds, etc.

Fidelity also serves as the Fidelity Cash Management Account to benefit its customers in money management. It works like a checking account plus carries many perks for its customers or account holders.

Fidelity Cash Management Account Features

The prominent features that the Fidelity cash management account holds are:

1. Direct Deposit

With a Fidelity CMA, you can deposit your pension, paycheck, and social security benefits directly into your account. You must provide your account and ABA routing numbers to a government agency, employer, or third party.

2. Electronic Fund Transfer (ETF)

ETFs can provide lower operating costs than traditional open-ended funds, greater transparency, flexible trading, and better tax efficiency in taxable accounts. Due to the numerous investment choices, there are more elements to review when making an investment decision.

3. Easy Access to ATM or Debit Card Withdrawal

You’ll get reimbursed for ATM transaction fees when using the card as a Fidelity cash management account. You can easily access cash in over one million ATMs across the world. Fidelity will not charge a fee whenever you use an ATM. In addition, it’ll refund any fees that you incur without any limit.

However, Fidelity demands a 1% currency conversion fee when you make ATM withdrawals from foreign ATMs.

If the ATM owner charges you any fees, Fidelity will reimburse you the same amount on the next working day. In addition, you do not need to pay for access to your money.

4. Automatic Investment and Withdrawal

You can schedule automatic withdrawals from your Fidelity cash management account, investment account, or bank for making recurring deposits to your IRA account and 529 college savings plan. To activate this feature, you must provide your bank information to Fidelity and start enjoying it within two to four working days. If you need to add and verify new banking information, it may take longer than usual.

5. Deposits Eligible for FDIC Insurance

The Fidelity CMA account allows you to save, spend, and invest your money per your needs. Any uninvested cash in your Fidelity CMA is eligible for FDIC insurance coverage.

The Fidelity CMA is insured up to $1.25 million by the FDIC, which automatically divides your balance among five different banks. This account is a good choice if you have a large amount of money and want to keep it safe.

6. A Good Cash Manager

The Fidelity CMA account is versatile and offers features similar to savings and checking accounts. With it, you can easily save, invest, and spend money. A no-monthly fee, no minimum balance requirement, and free standard checks make Fidelity CMA a good cash manager.

If you’re looking to invest some money in bonds or stocks, you must consider asset allocation. Asset allocation involves keeping some percent of money in high-risk investment options like stocks rather than low-risk investing options such as bonds. Fidelity helps its customers maintain their asset allocation accordingly.

7. Bill Pay Option

Easily manage your investments and bills in one place with the help of the Fidelity Cash Management Account. You can virtually Pay Bill to anyone, from your cable bill to your electrician.

Fidelity Cash Management Account Interest Rate

The Fidelity cash management account works like a checking account and has several savings account features. One of the features of Fidelity CMA is the capability to earn huge interest on the account’s balance.

These interest rates are divided into two types, and you can earn them based on your account balance.

An account balance of below $100,000 will earn lower interest rates. On the contrary, an account balance above $100,000 will earn higher interest rates.

Irrespective of your balance, the interest rate defeats the rate provided by several chains of giant banks.

However, online banking sometimes defeats the interest rates provided by Fidelity without any hardships. Therefore, if you’re mainly concerned with interest earning, you should pick another account.

Fidelity Cash Management Account Interest Rate

| Account Name | Minimum Deposit | APY (%) | Monthly Fees |

| Fidelity Cash Management Account | No minimum deposit | 2.72% | None |

Fidelity Cash Management Account Minimum Balance

It’s easy to open a Fidelity Cash Management Account as there is no minimum deposit requirement.

You can open the account without worrying about the Fidelity Cash Management Account Minimum Balance. You can add an amount if you want or even withdraw your initial deposit since you don’t need to maintain a minimum balance.

After opening the account, there are no monthly charges or Fidelity Cash Management Account Fees, which you need to pay. This ensures that your account is working and that you can keep your money in it.

Fidelity Cash Management Account Fees

Fidelity accounts offer a low fee and flexible experience to their customers. They don’t have monthly fees, ATM fees, or other common fees related to savings or checking accounts. These things make them an excellent pick for consumers who are conscious about fees.

| Type | Fee Amount |

| Out-of-Network ATM Fee | $0 |

| Monthly Maintenance Fee | $0 |

| Overdraft Fee | $0 |

| Incoming Domestic Wire Transfer | $10 |

| Incoming International Wire Transfer | Up to 3% |

| Stop Payment | $15 |

| Returned Item | $15 |

| Cashiers Check | $10 |

Is Fidelity Cash Management Account FDIC Insured?

The cash balances in the Fidelity CMA are swept into FDIC-insured interest-taking accounts at one or more program banks and under particular conditions.

The SIPC will cover $500,000 in securities, which includes a $250,000 cash limit in a brokerage account, which means SPIC covers all the Fidelity brokerage accounts.

Pros and Cons of Fidelity Cash Management Account

Pros

- ATM reimbursement: Fidelity account will reimburse ATM fees on any ATM with the Star, Plus, or Visa logo.

- No minimum withdrawal limit: You can make unlimited withdrawals for free, so you can easily access ATM cash when needed.

- Earn easy returns on cash: Increasing returns on your cash with FDIC insurance coverage.

- Mobile apps available: Mobile applications allow you to easily save and invest in the Fidelity CMA.

Cons

- Daily spending limits: The debit card may come with daily spending limits, which allow you to make only a certain amount of transfers at once.

- Comparatively lower returns: You can get several other accounts with higher yields, including the high-yield savings accounts, while you earn returns on your amount with the fidelity CMA.

- Few physical locations: You can access your account only through a few offline branches, whether for savings, investing, or spending.

You might also be interested in exploring other top-notch options. Check out our comprehensive guide on the 6 Best Cash Management Accounts in the USA to broaden your understanding and compare the best in the market.

Closing Words

The Fidelity Cash Management Account is an account that combines both checking and savings account features. If you have prepared yourself to work with Fidelity Investments, it’ll be an excellent account that lets you control your finances.

If you still need a Fidelity cash management account, investing in Fidelity will be a good pick because of its unique features and flexibility. However, if you’re looking for higher checking rates, you must consider online banks.

Happy Investing!

![What is Non-Banking Financial Company [NBFCs vs Banks] What is Non-Banking Financial Companies (NBFCs)](https://finbuzz.co/wp-content/uploads/2024/10/What-is-Non-Banking-Financial-Companies-NBFCs-218x150.png)

![What Are the 5 Cs of Credit? [Key Factors Lenders Consider]](https://finbuzz.co/wp-content/uploads/2024/10/Five-Cs-of-Credits-218x150.webp)