Table of Contents

While planning to secure your family financially, one of the preferred choices you have is to opt for a life insurance plan. It is the best way to secure your family monetarily in case of your demise. The dependents left behind you will not struggle to meet their ends, as the insurance amount will cover most of their expenses.

Amongst other insurance options, direct term life insurance is the most popular. In this insurance setup, you get straightforward offerings, easy accessibility, and affordable premium rates. It is important to know the details of this insurance category in detail before signing up for it.

In this article, we will discuss all you need to know in detail to understand what you can expect from this insurance plan.

What is Direct Term Life Insurance?

As the name suggests, a direct term life insurance policy is a policy that you can buy directly from your insurance provider. You do not have to engage with brokers or agents, and can directly sign up through the online platforms. This policy offers coverage for a set time period of 10, 20, or 30 years. During this time, if the policyholder passes away, the beneficiaries get the death benefits.

What makes it different from other life insurance policies is that it doesn’t accumulate cash value. It solely has a protection approach that makes it a budget-friendly and fruitful choice for many individuals.

Key Features of Direct Term Life Insurance

Here are the fundamental features of direct term life insurance that you can expect to get in your policy.

Term Based Coverage

You can enjoy the coverage of these insurance policies only for a fixed duration. It is up to you to decide the duration, be it 10, 20, or 30 years, depending on your financial needs.

Simple Application Process

The application process is simple and convenient. You can apply digitally without the assistance of any agents. Moreover, the approval is also quick without stringent paperwork.

Cost-Effective Premium

These policies solely focus on life coverage, so the premiums are affordable, unlike the other life insurance options. Moreover, the premium remains the same for the duration that you choose.

Straightforward purchase model

You do not have to deal with agents or brokers, making the entire loan application process straightforward and fuss-free.

No Cash Value

In direct term life insurance policies, you do not get a savings or investment component. So, the policy doesn’t accumulate the cash value.

Apart from these offerings, a few policy issuers let their clients customize the terms and offer coverage for critical illnesses as well. It is advisable to check the terms with your policy provider carefully before signing up.

Benefits of Direct Term Life Insurance

Direct term life insurance offers multiple benefits for the policyholders. Let us discuss a few of them in detail.

Cost Effectiveness

As this insurance policy is only focused on your life coverage, it eliminates the chances of getting higher premiums or investments. Hence, it is the most economical option for those who are looking for a cost-effective coverage option.

Ease of Access

You can avoid the waiting time and get rid of paperwork and other formalities with direct term life insurance. There are no agents involved; you can access it by simply switching to a digital platform of your insurance provider.

Dependents’ Financial Security

Your policy beneficiaries get financial safety through this insurance option. In case of your demise, the dependents get the money to cover their essential expenses.

Predictable and Fixed Premiums

Once you have decided the time period for which you need the insurance cover, the premium gets fixed. There are no surprises; the premium that gets fixed stays the same till the end of the term.

No Hidden Fees

You will buy the policy directly from the issuer without the intervention or assistance of any agent. So, you will not be paying any commission or hidden amount in the name of fees.

Who Should Consider Direct Term Life Insurance?

Not all insurance policies are for everyone. When you think of direct term life insurance, here’s a breakdown of people or the category of individuals who might consider opting for this policy option.

- Young parents who have just begun their financial planning journey but wish to keep the future of their children secure. It will give a sense of peace that the dependents in their family will be safe in case anything happens to them.

- Individuals who have a huge mortgage on their name can plan to opt for this insurance plan. This way, their family does not have to bear the burden if they pass away.

- People who are looking for affordable life insurance policies that offer excellent coverage with a cost-effective premium should opt for the direct term life insurance policy.

- Individuals who have to repay the loans and need coverage for only a short time duration. You can choose the time according to your requirements and stay stress-free until your financial obligations are over.

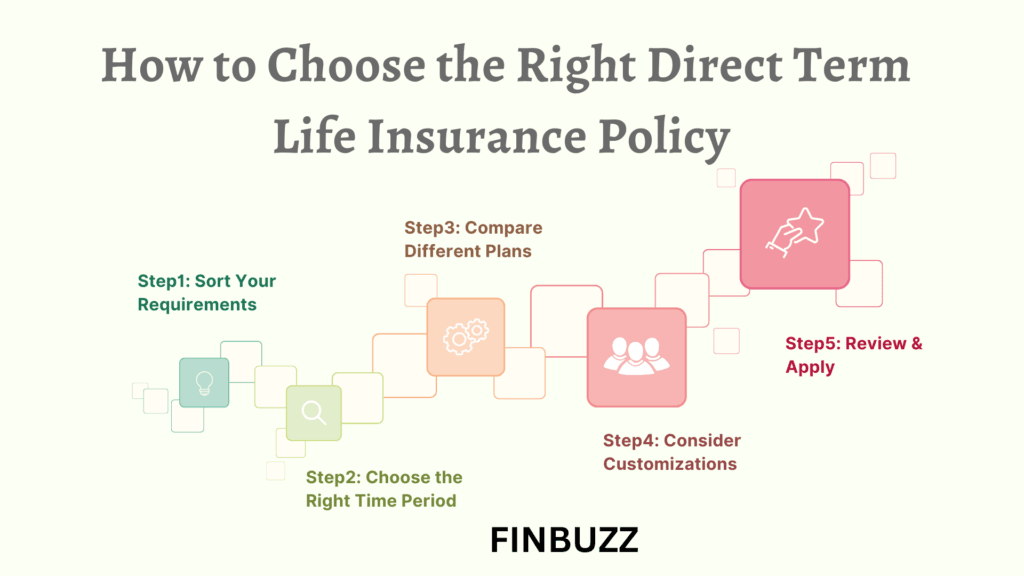

How to Choose the Right Direct Term Life Insurance Policy

Now, the next question that arises here is how you can choose the best direct term life insurance policy for yourself. There are multiple insurance providers offering various plans. How will you know which one is best for you?

Here is the step-by-step approach that you can follow to make the right decisions.

Step 1: Sort Your Requirements

Start by having a thorough understanding of your requirements. Assess what all you need to cover under the insurance plan, like debts, education, daily expenses, and more. This will help you identify the amount you need as insurance coverage.

Step 2: Choose the Right Time Period

Moving on, the next step is to decide the time for which you need this insurance coverage. If it is only until you pay off your debts, you can choose the minimum duration. However, if you need it for a lifetime, choose the highest available time duration, and you can keep extending the plan as per your requirements.

Step 3: Compare Different Plans

There are different insurance options available in the market. So, to ensure you do not sign up for the wrong plan, you should be ready to do thorough research and compare different plans. Check their offerings and the terms at which they provide the coverage; keep narrowing the options and finalize the plan that stands tall on all your requirements.

Step 4: Consider Customizations

A few insurance providers let you customize a few terms, offering coverage against critical illnesses as well. You can enquire if your preferred insurance provider offers these customizations and whether you wish to avail of these terms.

Step 5: Review & Apply

Once you have decided everything, check the policy documents carefully, paying attention to the terms and conditions. If everything seems right, you can sign up for the policy and enjoy its perks.

Limitations of Direct Term Life Insurance

Though there are enormous perks of a direct term life insurance plan, it comes with certain limitations as well. Some of the limitations you should keep in mind are:

- Once the selected time period ends, the coverage also stops. So, unless you renew the plan, there is no protection available.

- These policies do not build any cash value, so you do not get any returns if the term period expires.

- The premium will increase if you plan to renew the policy once it ends.

So, it is advisable to sign up for this insurance plan only if these limitations don’t make any difference and the policy plan you choose still aligns with your coverage requirements.

How Direct Term Life Insurance Works in Practice

To help you better understand how direct term life insurance works in real scenarios, let us discuss a case study.

40-year-old Jay buys a direct term life insurance policy of $1,000,000 with a 20-year term duration. He would have to pay the premium of $50 per month.

Now, if Jay dies during this period of 20 years, his beneficiary will receive a death benefit of $1,000,000 that will help them meet their daily expenses, studies, and more. This way, his family wouldn’t have to struggle for finances in his absence.

On the other hand, if Jay outlives this duration, the policy expires, and there is no payout involved. Still, people opt for it as the peace of mind it offers during financially challenging times makes it worth it.

Conclusion

Direct term life insurance is a promising, cost-effective, and easily accessible plan that caters to the needs of those who want coverage for only a certain period. Moreover, if you want to sign up for an insurance program without frills and a complicated application process, it is the highly suggestive category of insurance.

Despite its limitations, like short-term coverage and no cash value, people opt for it, because it is cheap, easy to purchase, and convenient to access. All you have to do to reap all the benefits is to find the right policy after a comparative analysis of the policy offerings and your financial goals.

So, if you wish to secure your family’s future and live with the peace that their needs will be well taken care of even in your absence, find the right direct term life insurance and sign up for it!