Table of Contents

Saving for your family’s future can feel like a challenge, but with the right plans and accounts, it becomes much easier. Whether you’re thinking about your children’s education, building an emergency fund, or saving for long-term goals, there are plenty of options to help you get there.

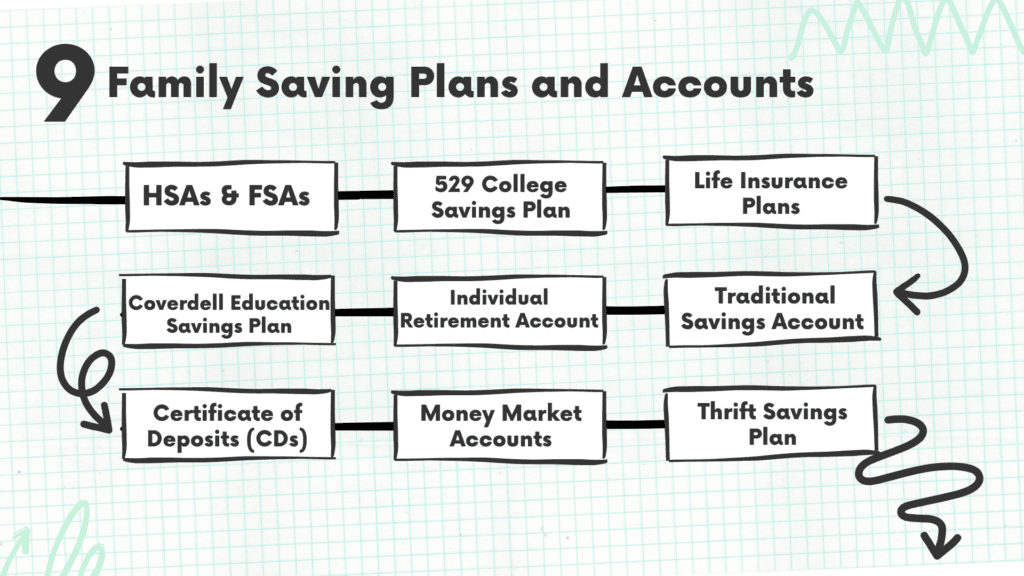

In this article, we’ll explore the top 9 family saving plans and accounts available in the USA for 2025. These options offer flexibility, growth potential, and benefits like tax advantages, helping you secure a solid financial future for your loved ones.

Discover the best strategies to save and grow your wealth for years to come.

What Do You Mean by Family Saving Plans?

Who hasn’t heard the famous phrase “to save for a rainy day?” Well, you might have! Family savings covers retirement funds, education fund loans, and car repayments. A ‘saving family’ can easily prioritize their needs and wants along with the fulfillment of their financial plans, generating the urge to go for family saving plans.

Top 9 Family Saving Plans and Accounts in the USA

1. Health Savings Account and Flexible Saving Account

Health saving accounts (HSA) and flexible saving accounts are crucial family saving plans that help you in offering tax relief in help care expenses, and childcare expenses also (in the case of FSAs).

Their names might sound similar to you but have a vast difference, let’s look into them:

HSAs

- Doesn’t need to be sponsored by an employer

- Can only spend the amount on qualifying health-related expenses

- Can easily be rolled up year to year

- It is a high-deductible health insurance plan

- Extra source of building retirement savings

- Can earn interest

If you want to learn more about the Best HSA Providers of 2024 we have a separate guide for it. You can check out that.

FSAs

- Must sponsored by an employer

- Available for both childcare and healthcare expenses

- Don’t roll over, if you do not use the money, you’ll probably lose it

- Do not need to have a high-deductible health insurance plan

- Must be set up with a deposit amount that should be declared at the beginning of the year which cannot be changed

2. 529 College Savings Plan

A 529 college savings plan is our personal favorite in the list of family saving plans as it allows you to save for both post-secondary education and K-12 education costs (before this, only post-secondary education costs were allowed.)

A 529 savings plan is divided into two broad categories: prepaid tuition plans and savings plans. Where a savings plan means to invest and grow your savings tax-free. On the other hand, prepaid tuition plans mean paying for future attendance at specific schools. A 529 college saving plan is further evaluated on some key factors like fees, ease of use, various investment options, reputation, and performance.

3. Coverdell Education Savings Plan

Coverdell education savings account is a custodial or trust account that can be leveraged to pay for post-secondary, secondary, or elementary education expenses. Tax-free distributions are always made in case of qualifying expenses, though if some money remains in the account after the beneficiary turns thirty, it needs to be distributed and then taxed.

4. Life Insurance Plans

Opting for a life Insurance policy is an excellent plan when speaking of family saving plans to accumulate income and growth. Life insurance policies carry some cash value in the form of universal life or whole life. With the ease of death benefit and cash component that may be drawn down or borrowed against while the insured is still alive.

Here, the wealth grows each year at a modest rate, which is tax-free. If you withdraw the contributed amount, you’re not liable to pay any taxes. Apart from this, you can even borrow against the cash value of your policy tax-free and allow the dividends to safeguard the interest expenses.

Check out the differences between Term Life and Whole Life Insurance to make a better decision about which life insurance you need.

5. Traditional Savings Account

A traditional saving account and plan earns interest on funds available in your account. The APY in traditional accounts can differ across various financial institutions. Some provide low APYs (0.50% APY) as compared to the ones that provide an APY of 5.00%.

In such accounts, withdrawals are limited to six/month. However, the idle banks offer an ATM card for cash withdrawals, and these are usually unlimited transactions.

6. Certificate of Deposits (CDs)

Certificate of deposit (CDs) accounts allow you to save money for a limited time frame at a fixed or high interest rate. You are not allowed to withdraw your funds during the term of three months to some extended years (not more than 10 years).

If you withdraw the funds before the end of the tenure, you need to pay the charges. These charges will depend on the CD tenure and entail an interest duration of 60, 90, or 120 days.

7. Money Market Accounts

Money market accounts (MMAs) are the type of accounts or family saving plans that provide interest with the best high-yield savings accounts and usually allow the use of checks and debit cards (which most of the HYSAs do not offer.) However, some MMAs have a requirement of a minimum balance that triggers a monthly fee amount as well.

Unlike other family saving plans, withdrawals are only limited to six/month, with no limitations on ATM withdrawals. The interest rates on MMAs vary and may change accordingly.

8. Individual Retirement Account

Individual Retirement Accounts (IRAs) help you to save your money on taxes in manifold ways. The money invested in a Roth IRA was taxed before being deposited, and the interest amount will be tax-free when you withdraw the money at the time of retirement.

Traditional IRAs allow you to deduct from your contributed income which provides relief from the tax burden for that specific year. Your money will grow tax-free till it remains in your account. However, when you withdraw the amount, you need to pay the tax at the current rate on the money earned and deposits in the account.

Also, check out this blog on Financial Planning for Retirement for smart money moves.

9. Thrift Savings Plan

Thrift Savings Plan is a retirement plan for armed force members plus civil service workers employed by the US federal government. It is a defined contribution plan that provides several benefits to federal employees and military personnel in the private sector.

TSP has become famous in the past years because of its low administrative cost, tax advantages, and simplicity which is the most trusted amongst service members and millions of government employees.

Is Anything Left?

Family saving plans are generally taxed on the earned interest. So, if you are investing in a tax-free family savings account, you’ll be able to make the most of it.

So, if you’re planning to invest in these plans or accounts, take a consultant from a financial expert or do thorough research. Financial planning is a must before investing in any plan so pick your preferred account and enjoy the great services and features offered by them.

Happy Savings!

![What Is CLS in Insurance? [Guide to Protect Your Business] What Is CLS in Insurance Protect Your Business Today](https://finbuzz.co/wp-content/uploads/2024/12/What-Is-CLS-in-Insurance-Protect-Your-Business-Today-218x150.jpg)