Table of Contents

When it comes to personal finance, one thing that often comes up is your credit score. Whether you’re applying for a loan, a credit card, or even renting an apartment, your credit score plays a big role in those decisions.

But here’s the thing: many people are familiar with the term “credit score,” but there’s also a specific type of score called the “FICO score.” So, what’s the difference between them, and why should you care?

Let’s break it down and make it simple to understand.

What is a FICO Score?

A FICO score is one of the most popular types of credit scores used by lenders to evaluate your creditworthiness. It’s created by a company called Fair Isaac Corporation (that’s where the name “FICO” comes from).

Your FICO score ranges from 300 to 850, and the higher the score, the better your credit is considered to be. So, if you’re closer to 850, you’re in good shape.

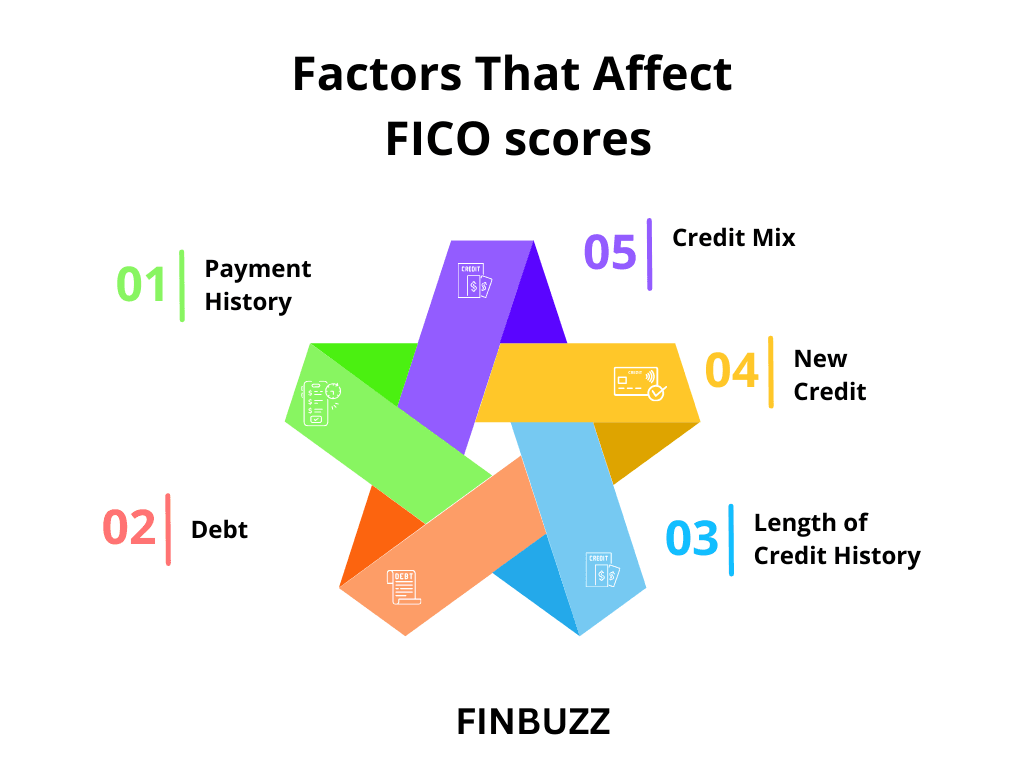

Factors That Affect FICO Scores

Several things go into calculating your FICO score. Let’s look at the main factors:

Payment History (35%)

The most significant factor influencing your FICO score is your history of payments. It is mainly focused on whether you have made all your payments on time, be it paying any premiums, clearing bills, or clearing your mortgage.

Debt (30%)

This factor focuses on the total amount of debt you owe to a bank or any other financial institution. It is significant to note here that your credit card balance and usage are also monitored under this factor.

Length of Credit History (15%)

The time period for which you have used your credit accounts also influences your FICO score. A longer credit history signifies that you can manage the debt responsibly, and you will be achieving a high FICO score.

New Credit (10%)

If you have opened multiple credit accounts in a short span of time, it signals financial instability. It will have a negative impact on your FICO score, which can lead to loan rejections.

Credit Mix (10%)

Lenders like to see that you can handle different types of credit, such as credit cards, installment loans (like car loans), or even a mortgage. Having a mix shows that you can manage a variety of debts.

What is a Credit Score?

A credit score is a number that represents your creditworthiness. It’s basically a snapshot of how well you manage debt. While the FICO score is the most well-known, it’s not the only score out there. There are other credit scoring models, like VantageScore, that also help lenders make decisions. But most people generally talk about “credit scores” without specifying which model they mean.

Credit scores, whether FICO or another model, usually range from 300 to 850, and the higher your score, the more likely you are to get approved for loans, credit cards, and other forms of credit.

Factors That Affect Credit Scores

Just like with the FICO score, the factors that influence other credit scores are pretty similar:

Payment History: Like the FICO score, the majority of credit scoring systems assign the highest value to your past payment patterns. It means missed payments or defaults will affect your score in a negative way.

Credit Utilization: One variable that is included across every model is credits used in proportion to total credit. It is the same way with the ratio; a low ratio will mean a high rating of your credit score.

Recent Credit Activity: The majority of scoring models include recent credit inquiries or new accounts as a red flag. Moreover, if they find your account seeking many inquiries in a relatively short period of time; they take it as a sign of financial instability.

Credit Mix: The credit types include credit cards, mortgages, and car loans, all of which can increase your credit score under most credit models.

Public Records: Credit scores can be affected by bankruptcies, collections, and other records, and such records can be treated differently in different models.

Key Differences between FICO and Credit Scores

We have thoroughly discussed FICO and credit scores. Now, refer to the table below to understand the key differences between both these values.

| Feature | FICO Score | Credit Score |

|---|---|---|

| Scoring Model | Proprietary FICO algorithm | Weightings are the same but they may vary by models |

| Developer | Fair Isaac Corporation (FICO) | Various organizations, like VantageScore, Experian |

| Score Range | Between 300 and 850 | Varies for different models |

| Usage | Used by 90% of the lenders in the USA | Used by very few lenders |

| Primary Factors | The primary focus is on payment history, debt, length of credit history, and types of credit | High Familiarity among lenders |

| Reliability | Considered most reliable by the lenders | Not as widely trusted as the FICO model |

| Familiarity Level | High Familiarity amongst lenders | Moderate familiarity as it is less frequently used. |

| Customization | Standardized model | Customization is available under different models. |

Why Lenders Prefer FICO Scores

Here are a few reasons lenders in the USA prefer FICO scores over all other methods.

Reliability Factor

FICO has an excellent reputation for providing consistent credit assessments and has been holding on to it for many years. Moreover, FICO works consistently to refine its scoring model, eliminating any drawbacks that users report.

Global Acceptance

FICO is used by a majority of lenders. Thus, it forms a standardized way of assessing the creditworthiness of a borrower. From banking to finance and real estate, lenders in every domain accept the FICO score, making it a go-to option for lending decisions.

Predictive Power

The model has been tested over time and validated by multiple sources for having a highly accurate predictive power. The FICO score is the most accurate calculation in predicting whether a borrower can default on a loan.

Familiarity

Another common reason is that lenders are familiar with the FICO scoring model and have been using it for years. Hence, they are comfortable with using it and are not ready to switch to another creditworthiness calculator.

When Other Credit Scores Matter

While the FICO score is the standard for evaluating the creditworthiness of an individual, there are other models as well that are still considered by many lenders. Let us discuss the scenarios when other credit scores come into play.

VantageScore

This is typically used by small lenders for a specific category of loans. This score is most commonly used for individuals who have few or no credit files at all.

Alternative Credit Scoring

If the borrower has higher credit inquiries or does not have sufficient credit history to monitor, the lender may use alternative scoring models. In these alternatives, their utility bill payment or rental history is taken into consideration.

Insurance & Loan Decisions

FICO score is a popular choice for loan providers and insurance companies. However, there are a few employers that may use alternative credit scores that influence your monthly premium or loan eligibility.

How to Interpret Your Credit Scores

Calculating the credit scores is not enough. You must understand how to interpret these scores to make well-informed financial decisions. Listed below are a few score ranges and their rating on the scale of poor to excellent.

300- 579: Poor

At this level, it might be difficult to get approved for credit, and if you do, the interest rates will likely be very high.

580-669: Fair

Borrowers with a credit score in this range may get their loan qualified, but the terms will not be very favorable.

670-739: Good

In this credit score range, the borrowers are at less risk of getting a rejection. Moreover, the rate at which your loan gets granted will also be favorable.

740-799: Very Good

It is a great credit score range that indicates promising creditworthiness. If you fall in this range, you can qualify for the best interest rates.

800-850: Excellent

Borrowers in this range are at the least risk of rejection. Under this range, you will get qualified for almost every loan and insurance with terms that are favorable to your financial goals.

How to Improve Your Credit Score

If your credit score is low then there are some tips you can consider to improve your credit score. This includes:

Pay Your Bills on Time

Since payment history makes up a large part of your score, paying bills on time is very important.

Reduce Your Debt

Paying down high balances, especially on credit cards, will help improve your credit utilization and boost your score.

Avoid Applying for New Credit

Each new credit application can cause a small dip in your score, so it’s best to limit how often you apply for new credit.

Check Your Credit Report for Errors

Mistakes on your credit report, such as incorrect late payments or account information, can lower your score. Make sure everything is accurate.

Keep Old Accounts Open

The longer your credit history, the better. Keeping old accounts open, even if you don’t use them often, can help your score.

Pay off Any Collections

If you have accounts in collections, paying them off can help improve your score over time.

To learn more tips to improve your credit score, you can check out our dedicated article in which we have discussed 11 Best Tips to Improve Credit Score.

Conclusion

It is fair to say that FICO score and credit score are two very important factors that can be used to determine one’s credit standing. FICO stands for Fair Isaac Corporation and is the most used credit score by lenders, acting as the benchmark for the credit risk assessment of a borrower. However, there are other credit scores like VantageScore that are often not used to make lending decisions.

Knowing what determines the credit score, how to read it, and why FICO scores are the most commonly used by lenders will assist you in making better financial decisions. In any case of a loan, mortgage, or credit card, this awareness of your score and how it can be manipulated can make a world of difference in one’s financial prospects.