Table of Contents

Just bought a new sofa from Levin Furniture and ended up with some extra credit on your Levin Furniture credit card? Or maybe you returned something and now have store credit you’d rather have as cash? Figuring out how to actually get that money can be a bit tricky. But don’t worry, we’re here to help!

In this blog post, we’ll break down everything you need to know about how to cash out your Levin Furniture credit card. We’ll explain the different types of Levin credit cards, the options for accessing your funds, and some important things to consider before you cash out.

We’ll even give you some alternative ideas for using your credit if you don’t need the cash right away.

So, if you’re ready to turn that Levin Furniture credit into cold, hard cash, keep reading! We’ll guide you through the process and help you make the most of your credit.

Levin Furniture Credit Card: Types and Benefits

Now before you go trying to access funds on your Levin Furniture card, you need to know what type of credit that is. That will determine how you can use the card and, if applicable, the way to get cash.

1. Types of Credit

At Levin Furniture you may find several credit card types. They may have their own store credit card, which is a credit card that can only be used for purchases made at Levin Furniture stores.

They could also have a co-branded credit card, which is a credit card that has the Levin Furniture logo on it. However, it will also be tied into a major credit card network like Visa or Mastercard.

2. Store Credit

This means that the credit is only valid for purchases at Levin Furniture if you have a Levin Furniture store credit card. You can’t use it to withdraw cash or shop at other stores. It’s like a gift certificate you can use to purchase furniture at Levin.

3. Co-branded Credit Card

If Levin Furniture offers a co-branded credit card, it will likely function more like a regular credit card. That means you may be able to use it to make purchases anywhere that accepts the major credit card network it’s associated with (such as Visa or Mastercard).

You might also have more ways to take the credit as cash (e.g., cash advances or balance transfers) — but again, read the terms of the card to be sure.

ALSO READ: Can You Pay for a Passport with a Credit Card

How to Get Cash With Levin Furniture Credit Card

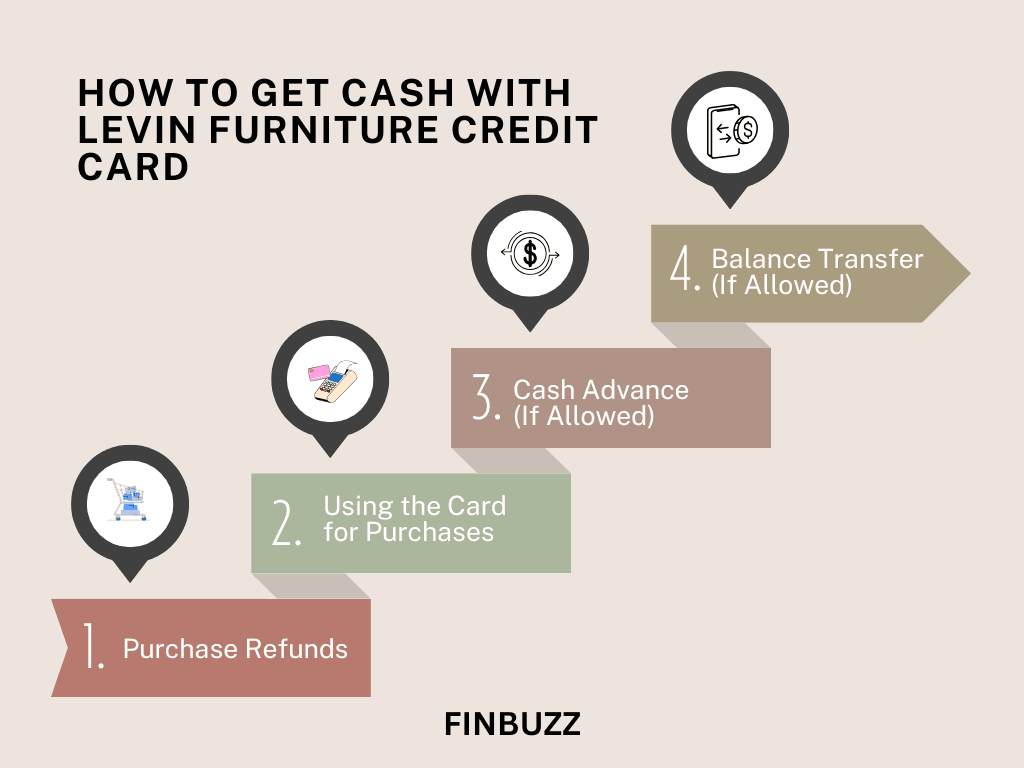

If you have credit available on your Levin Furniture credit card and would like to access those funds, then you can consider one of the following options:

1. Purchase Refunds

If you recently bought something from Levin Furniture but need to return it, you may be able to get a cash refund rather than store credit. But that depends on Levin Furniture’s return policy.

Some of the stores might only give store credit for return and other stores might give you cash refund. Check their return policy, or ask a customer service representative for details before you make a return.

2. Using the Card for Purchases

A co-branded Levin Furniture credit card can be used as a standard credit card for purchases wherever that card’s network is accepted (Visa or Mastercard, for example). This can free up cash you would have otherwise taken out of your checking account or other credit cards.

If you’re among those who have to purchase groceries or gas, for example, you can use your Levin Furniture credit card rather than cash or another credit or debit card. It means you get to retain the cash you’d have otherwise had to spend and basically use the credits on your Levin card instead.

3. Cash Advance (If Allowed)

Some credit cards offer the option of a cash advance, meaning you can use an ATM or bank to withdraw cash, as opposed to other forms of currency. But this type of debt often has high fees and interest rates.

You will typically have to pay a fee for the cash advance, plus cash advances often charge a higher interest rate than the regular purchase APR. That means you’ll be paying more over the long term. Therefore, you shouldn’t take cash advances unless you absolutely have to.

4. Balance Transfer (If Allowed)

A balance transfer is the process of transferring your credit card balance from one card to another card. Certain credit cards allow balance transfers to a bank account, which would essentially give you cash access to the funds.

But balance transfers sometimes involve fees, and the new account’s interest rate may exceed your existing rate. So think carefully about the fees and the interest rates before you decide for a balance transfer.

Important Considerations While Cashing Out Levin Furniture Credit Card

There are a few key things to remember before you attempt to cash your Levin Furniture credit card out:

1. Levin Furniture’s Policies

Levin Furniture has their own terms and conditions for how their credit card works. Therefore, you must read their refund and credit access policies carefully and separately. These policies differ, so you may want to look at its website or call its customer service department to see the specific rules and restrictions on your card.

They could, for instance, have limitations on the amount of credit you can spend at one time, or how refunds are processed.

2. Fees and Interest

You must understand that certain ways of accessing funds from your Levin Furniture credit card can incur fees and interest charges. For example, if you take out a cash advance, you’re likely to incur a fee on that transaction, and the interest rate on cash advances is typically much higher than your regular purchase APR.

Likewise, balance transfers may also come with fees, and the APR on the new account may be higher. Before making any decisions, always make sure to read the fine print and understand any potential costs involved.

3. Credit Score Impact

Some things, such as taking a cash advance, could hurt your credit score. Cash advances are generally viewed as a sign of financial trouble and can damage your credit utilization ratio. That is the amount of credit you’re using as a percentage of your total available credit.

Your credit score may fall as a result of high credit utilization. So, if your credit score is of concern to you, it’s usually a good idea to stay away from cash advances. Instead, you can consider other alternatives to accessing your credit.

YOU MAY ALSO LIKE: Get a Startup Business Credit Card With No Credit History

Alternatives to Cashing Out Your Levin Furniture Credit Card

If you’re not in immediate need of cash, there are a few alternatives to cashing out your Levin Furniture credit card that you might want to consider:

1. Saving the Credit

One of the simplest and most effective ways to use your Levin Furniture credit is to save it for future furniture purchases or home décor needs. Perhaps you’re planning to redecorate your living room or upgrade your bedroom furniture in the near future.

Instead of cashing out your credit now, you can hold onto it and use it towards those purchases when you’re ready. This way, you can get the furniture or décor items you want without having to pay for them upfront or use another form of credit.

2. Gifting the Credit

If you don’t have any immediate plans to use your Levin Furniture credit, and if their policy allows it, you might consider gifting the credit to a friend or family member. This can be a thoughtful and helpful gesture, especially if someone you know is planning to furnish a new home or needs to replace some furniture.

It will be like a gift certificate that they can use to choose the items they need most. However, before you do this, make sure to check Levin Furniture’s terms and conditions to see if transferring credit to another person is permitted.

Wrapping Up

So, there you have it! We’ve explored a few different ways you might be able to access the funds on your Levin Furniture credit card. Whether it’s through purchase refunds, using the card for everyday purchases, or exploring options like cash advances or balance transfers, there might be ways to turn that credit into cash.

Remember, it’s always crucial to check Levin Furniture’s specific policies and understand any potential fees or impacts on your credit score before making any decisions. Don’t hesitate to reach out to their customer service if you have any questions.

If you don’t need the cash right away, remember those alternatives! Saving your credit for future furniture purchases or gifting it to a loved one can be smart ways to use those funds.

No matter what you decide, we encourage you to use your credit responsibly and make choices that align with your overall financial goals.